Ultimate Guide to Personal Loans: Everything Explained

In India, personal loans have become a popular way to handle sudden expenses, essential needs, and personal goals. But before taking one, it’s important to understand what a personal loan really is, how it works, what the drawbacks are, and the rules or factors you should carefully consider before applying.

In this detailed guide, we will cover:

- What is a Personal Loan and its rules?

- Key features and types of personal loans

- Eligibility criteria and required documents

- Interest rates and charges

- Advantages and disadvantages of taking a loan from a trusted NBFC like DMI Finance

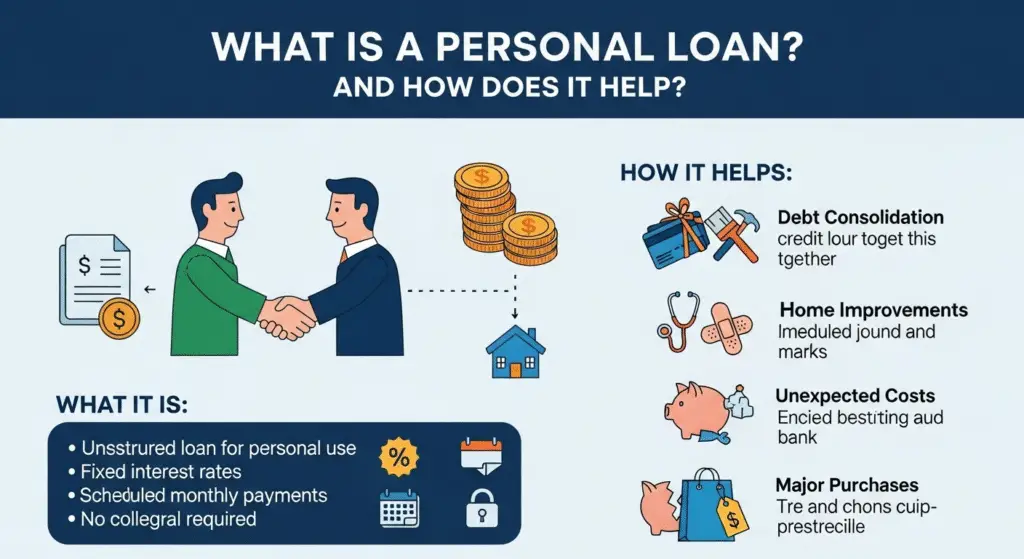

What is a Personal Loan and How Does it Help?

A personal loan is an unsecured loan (without collateral) that anyone can apply for through a bank or NBFC (like DMI Finance). Unlike secured loans, you don’t need to pledge any assets (such as house, car, or gold), but complete verification is mandatory.

A personal loan is a type of installment credit offered by banks, credit unions, or online lenders. To qualify, you must meet the lender’s eligibility requirements, and full verification of your documents and profile is done.

If approved, you can use the loan for almost any purpose—though lenders may approve a slightly lower amount than you requested. Common uses include home renovation, large purchases, medical emergencies, education expenses, or weddings.

Repayment responsibility lies with you. Many personal loans also come with loan insurance, meaning in the event of the borrower’s death, the family may still have to settle the repayment through the insurance claim. Repayment is usually done through fixed EMIs (Equated Monthly Installments), which include both principal and interest. Missing EMIs can lead to penalties and a negative impact on your credit score.

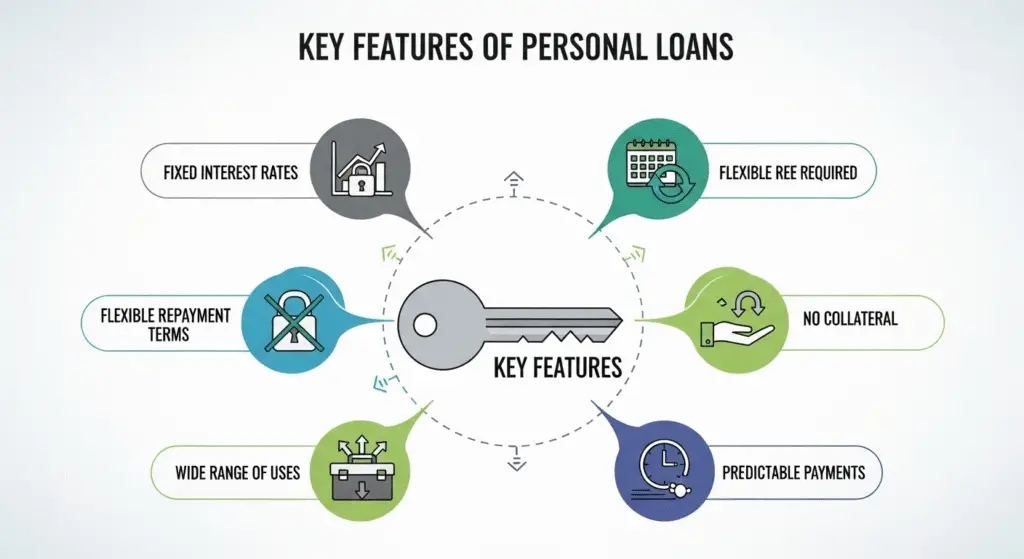

Key Features of Personal Loans

- Multipurpose use – Can be used for medical emergencies, travel, weddings, home renovation, education, or gadget purchases.

- No restriction – Unlike home or car loans, personal loans are not tied to a single purpose.

- No collateral required – Purely unsecured, but proper verification is required.

- Easy online application and quick disbursal.

- Fixed EMI makes budgeting easier, but the interest rate is relatively higher.

- Flexible repayment tenure (from 12 months to 48 months or more).

- NBFCs like DMI Finance simplify the process, but it’s important to carefully read terms and conditions.

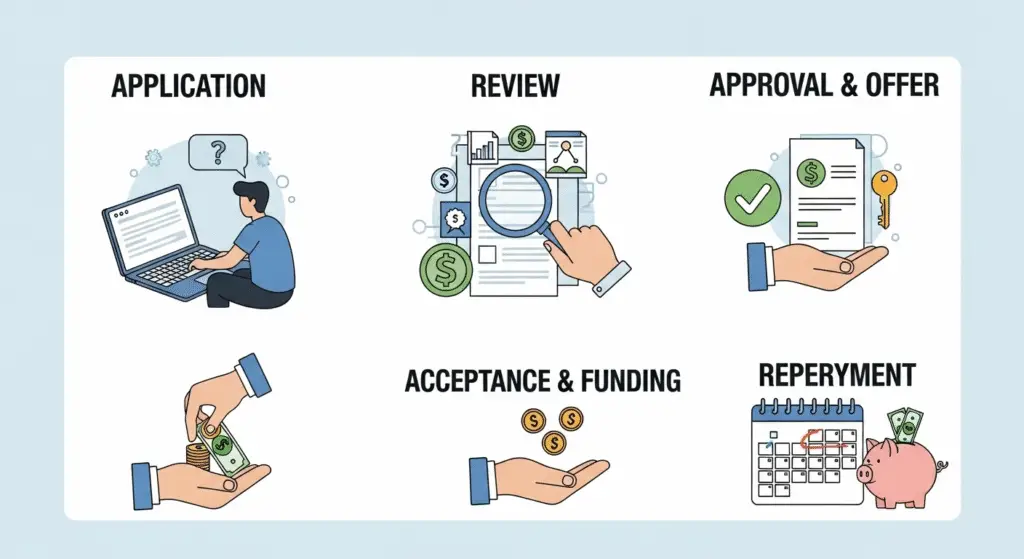

How Does a Personal Loan Work?

- Application – Submit online or through a branch.

- Evaluation – Income, credit score, and documents are checked and verified.

- Approval – The loan amount is sanctioned based on your profile.

- Disbursal – Funds are directly transferred to your bank account. If you opt for insurance, the premium is deducted upfront.

- Repayment – Monthly EMI payments as per the fixed schedule. Missing payments can attract penalties.

Common Uses of Personal Loans

- Debt Consolidation – Paying off multiple loans or credit card dues.

- Medical Expenses – Handling emergency healthcare costs.

- Home Renovation – Repairs, interiors, or redesign.

- Wedding – Covering marriage-related expenses.

- Education – Tuition fees, exam charges, or courses.

- Travel & Gadgets – Funding trips or purchasing expensive electronics.

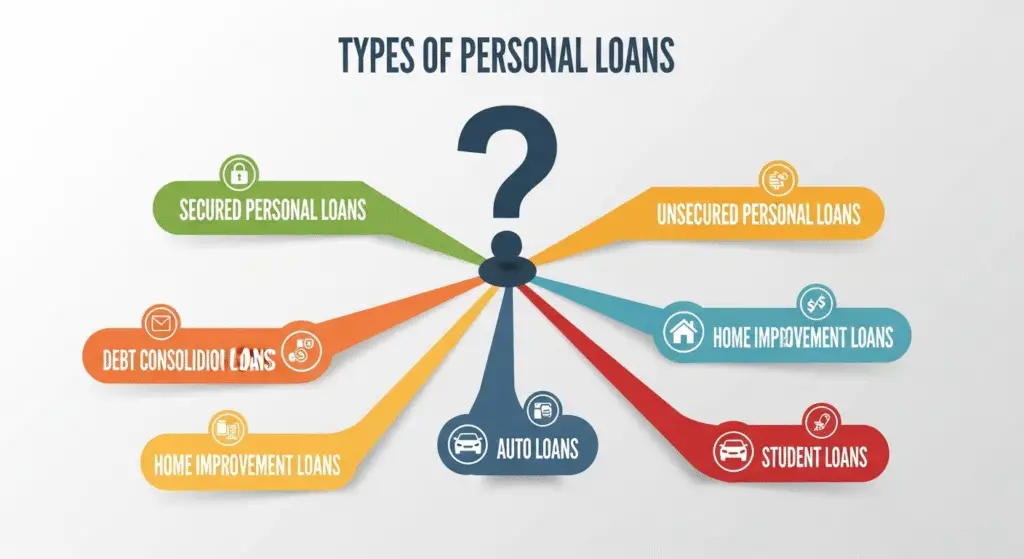

Types of Personal Loans

- Unsecured Personal Loan

- No collateral required.

- Riskier for lenders, so interest rates are higher.

- Approval depends heavily on credit score and income.

- Missing EMIs leads to penalties and poor credit history.

- Secured Personal Loan

- Requires collateral such as property, FD, insurance policy, or gold.

- Lower interest rates but conditions apply.

- Useful for larger loans or for those with a low credit score.

- However, defaulting risks losing pledged collateral.

Key Features (Table)

| Feature | Description |

|---|---|

| Collateral-Free | No need to pledge assets or security |

| Flexible Amount | ₹50,000 – ₹5,00,000 (via DMI Finance) |

| Fixed EMI | Same monthly installment |

| Custom Tenure | 12 – 48 months |

| Fast Disbursal | Within 24–48 hours |

| Digital Process | 100% online application and tracking |

Personal Loan Eligibility (DMI Finance)

| Criteria | Requirement |

|---|---|

| Age | 23 – 52 years |

| Monthly Income | Minimum ₹25,000 |

| Employment | Salaried or self-employed |

| Documents | PAN & Aadhaar linking mandatory |

| Credit Score | 700+ preferred |

Required Documents

- PAN Card & Aadhaar Card

- Latest Salary Slips / Income Proof

- Identity Proof

- Address Proof (Electricity Bill, Rent Agreement, etc.)

👉 With DMI Finance, the entire KYC process is digital, making it quick and hassle-free.

Interest Rates & Charges

| Charge Type | Range |

|---|---|

| Interest Rate | 14.25% – 24.90% per annum |

| Processing Fee | Up to 3.95% of loan amount |

| Prepayment Charges | Up to 4% |

| Late Payment Penalty | Up to ₹1,200 per missed EMI |

Benefits of DMI Finance Personal Loan

- Quick Approval – Hassle-free process

- Simple Documentation – Digital KYC

- Custom Loan Amounts – ₹50,000 to ₹5,00,000

- No Hidden Charges – Transparent policies

- Safe & Trusted – RBI-registered NBFC

Frequently Asked Questions (FAQs)

- What is a personal loan and is it risky?

It’s an unsecured loan with fixed EMI repayment. It’s safe if managed properly, but risky if you default. - What are the main features?

- No collateral

- Fixed EMI

- Flexible usage

- Quick disbursal

- Who can apply?

- Indian citizens

- Age 23+

- Minimum monthly income ₹25,000

- PAN & Aadhaar mandatory

- What documents are required?

- PAN, Aadhaar

- Salary Slip / Bank Statement

- Address Proof

- Can I apply online?

Yes, via the DMI Finance app. - Can I prepay the loan?

Yes, but prepayment charges may apply. - Will missing EMIs affect my credit score?

Yes, it will negatively impact your credit history. - Can I take more than one personal loan?

Yes, provided you have the repayment capacity.

Financial Terms Simplified

| Term | Simple Definition |

|---|---|

| e-Mandate | Permission for auto-debit of EMIs from your bank account |

| NBFC | Non-Banking Financial Company (e.g., DMI Finance) |

| CIBIL Score | Credit score ranging from 300 to 900 |

| KYC | Identity verification process |

| Loan Prepayment | Repaying the loan before the scheduled tenure |

⚡ Additional Note (Added Data):

- Maintaining a good repayment history improves your CIBIL score and helps you get better loan offers at lower interest rates in the future.

- Always compare processing fees, hidden charges, and insurance costs before choosing a lender.

- Borrow only as much as you can comfortably repay—overborrowing leads to financial stress.