Introduction

Every person wants extreme financial security in life. Some want to buy a house, some need funds for their children’s education, while others prepare for a comfortable retirement. To fulfill all these dreams, the right investment is necessary which makes your life safe and secure.

But the problem is that many people, without knowledge, often invest in greed of “high returns” and take higher risks, suffering losses but not making safe investments. On the other hand, some people fear losses so much that they only keep money in savings accounts or cash, due to which inflation slowly reduces the value of money, and the money not only loses its value but also makes you fearful of taking risks.

So the question is – Do such investment options exist that are both safe and give good returns?

👉 The answer is – Yes.

In this article, we will discuss in detail:

- Why low-risk investments are necessary and how to do them

- Top low-risk high-return investment options available in 2025

- Comparison table (Risk vs Return)

- Pro tips related to investment and mistakes to avoid that will give you a secure option

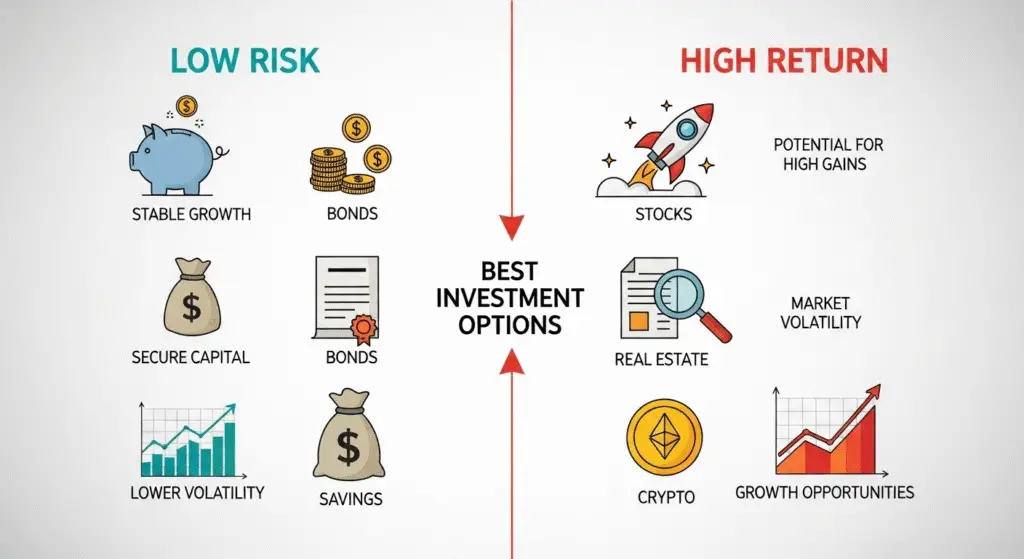

Why are Low-Risk Investments Important?

Many people think that only by investing in the stock market or cryptocurrency one can become rich. This is not completely true.

Low-risk investments are necessary because:

- Principal and savings remain safe – The investor’s money doesn’t drown and small but steady profits happen.

- Regular income – Interest, dividends, or rental income provide a stable option.

- Protection against inflation – Options like Gold and PPF keep you and your savings secure.

- Peace and stability – Even during a market crash, you don’t face much tension.

- Best for retirement planning – Easy and beneficial to build funds in the long term.

Top Low-Risk and High-Return Investment Options That Give You Security and High-Earning Potential

1. Fixed Deposits (FDs)

FD is the most popular and safe investment in India. It is completely secure and gives a fixed interest rate. Returns are lower but investment remains safe.

- Risk Level: Very Low

- Return: 7%–8% annually (APY)

- Tenure: 7 days to 10 years

- For Whom: People looking for safe investment

Example: If you invest ₹5 lakh in an FD at 7% interest for 5 years, you will earn around ₹2 lakh as interest.

Bank FDs and NBFC FDs are both available. NBFCs usually offer slightly higher interest. Senior citizens get extra interest benefits.

2. Recurring Deposits (RDs)

RDs are for those who prefer small investments. By depositing small amounts every month, big savings can be built.

You can invest a portion of your income every month.

- Risk Level: Very Low

- Return: 6%–7.5% annually

- Lock-in: 6 months to 10 years

- For Whom: Salaried people (IT and Government job holders)

Example: If you deposit ₹5,000 every month in an RD at 7% interest, in 5 years you will have around ₹3.6 lakh.

3. Public Provident Fund (PPF)

PPF is a long-term investment guaranteed by the government. Its interest is tax-free and it is a very good option.

- Risk Level: Extremely Low

- Return: 7%–8% annually (Tax-free)

- Lock-in: 15 years

- For Whom: Long-term and retirement planning — it secures your future

Tip: By investing ₹1.5 lakh annually in PPF, you can also avail tax exemption under Section 80C.

4. Government Bonds and Treasury Securities

Investing in government bonds is considered safe because they are backed by the government guarantee.

- Risk Level: Very Low

- Return: 6%–7% annually

- For Whom: Risk-averse investors

These are also used by big companies as they are reliable.

5. Corporate Bonds (AAA Rated)

Companies issue bonds to raise funds. AAA-rated bonds are considered very safe.

- Risk Level: Low

- Return: 7%–9% annually

- For Whom: Investors who want higher returns with safety

Tip: Always check bond ratings (like CRISIL, ICRA).

6. Mutual Funds (Low-Risk Category)

Not all mutual funds are risky. Some categories are especially safe.

- Debt Funds: Invest in bonds and government securities.

- Liquid Funds: Better returns than bank savings accounts with instant withdrawal facility.

- Hybrid Funds: A mix of equity and debt.

- Risk Level: Low–Medium

- Return: 6%–10% annually

Example: If you invest ₹10,000 monthly in a balanced fund with 10% CAGR for 10 years, you will have around ₹20 lakh.

7. Index Funds and ETFs

These funds track the entire market and over time give better profits.

- Risk Level: Low to Medium

- Return: 8%–12% annually

- For Whom: Long-term investors

These are the choice of big investors like Warren Buffet.

8. Real Estate Investment Trusts (REITs)

With REITs, you can invest in property without actually buying it.

- Risk Level: Low to Medium

- Return: 7%–12% annually

- For Whom: Property investors with small capital

Example: Embassy REIT in India is a popular option.

- SSC Postpones CGL 2025, Announces Retest for 55,000 Candidates After Technical Issues

- Manav Sampada: Uttar Pradesh’s Complete HRMS Portal

9. Gold Investments

Gold has always been considered a safe investment.

- Physical Gold – Jewelry or coins

- Gold ETF – Market-linked products

- SGB (Sovereign Gold Bond) – Issued by the government

- Risk Level: Low

- Return: 6%–10% annually (average)

Tip: In SGB, apart from gold price appreciation, you also get 2.5% annual interest.

10. National Pension System (NPS)

NPS is a safe pension plan for long-term investment.

- Risk Level: Low to Medium

- Return: 8%–10% annually

- Lock-in: Till the age of 60

- For Whom: Retirement planning

Tip: Investment in NPS provides additional tax exemption (up to ₹50,000).

11. High Yield Savings Account and Digital FD

Many fintech companies and small banks offer high-interest accounts. These are useful for short-term.

- Risk Level: Very Low

- Return: 5%–7% annually

- For Whom: Short-term savings and emergency funds

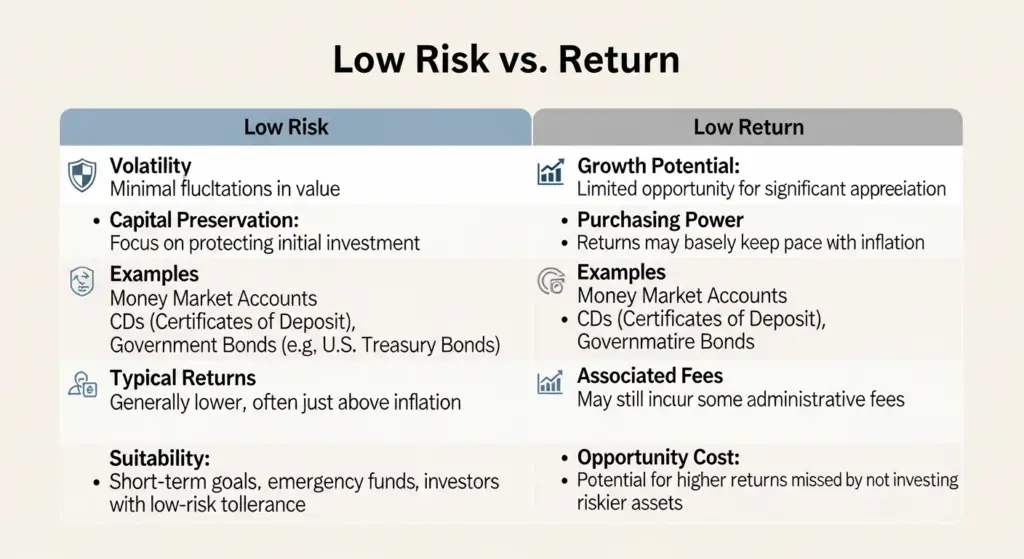

Comparison Table: Low Risk vs Return

| Investment Option | Risk Level | Estimated Annual Return | For Whom |

|---|---|---|---|

| Fixed Deposit (FD) | Very Low | 6% – 8% | Beginners, Retirees |

| Recurring Deposit (RD) | Very Low | 6% – 7.5% | Salaried people |

| PPF | Very Low | 7% – 8% (Tax-free) | Long-term |

| Government Bonds | Very Low | 6% – 7% | Safe investors |

| Corporate Bonds (AAA) | Low | 7% – 9% | Higher interest seekers |

| Debt Mutual Funds | Low | 6% – 8% | Beginners |

| Index Funds and ETFs | Low–Medium | 8% – 12% | Long-term |

| REITs | Low–Medium | 7% – 12% | Property investors |

| Gold (SGB, ETF) | Low | 6% – 10% | Inflation hedge |

| NPS | Low–Medium | 8% – 10% | Retirement |

| High Yield Saving Account | Very Low | 5% – 7% | Emergency fund |

Pro Tips for Investments

- Diversify – Don’t put all money in one place.

- Use SIPs – Invest small amounts monthly in mutual funds and index funds.

- Consider tax benefits – Check tax benefits while choosing investments.

- Maintain emergency funds – Keep at least 6 months’ expenses in liquid funds.

- Think long term – Don’t break your investments in haste.

Common Mistakes to Avoid

- Don’t depend only on FD or savings accounts.

- Don’t buy corporate bonds without research.

- Don’t ignore small expenses.

- Don’t keep changing investments frequently.

- Don’t ignore inflation.

Conclusion

If you want your money to stay safe and also earn well, low-risk options are the best.

FD, RD, PPF, government bonds, gold, and NPS provide strong financial security in the long run, while mutual funds, REITs, and index funds give slightly higher returns.

👉 Remember – The secret to wealth is not just “high returns” but “right and stable investments.”

If you adopt these options wisely, in 2025 and the coming years, you will not only save money but also become financially independent.